At the beginning of almost every pricing project, a pricing team needs to establish its data requirements. Unsurprisingly, it is uncommon for teams to obtain everything they would like to execute the most robust analysis possible.

At this juncture, it’s instinctual for many to want to jump into problem-solve mode to determine the next best approach absent the desired data. But does this approach serve a company best in the long-term? Sure, a pricing strategy or optimization recommendation can still be developed, but what implications does the limited data have downstream on pricing execution? All pricing experts know that you can develop the most “optimized” pricing sheet possible, but if execution fails, a company will not be able to capture the newly created value.

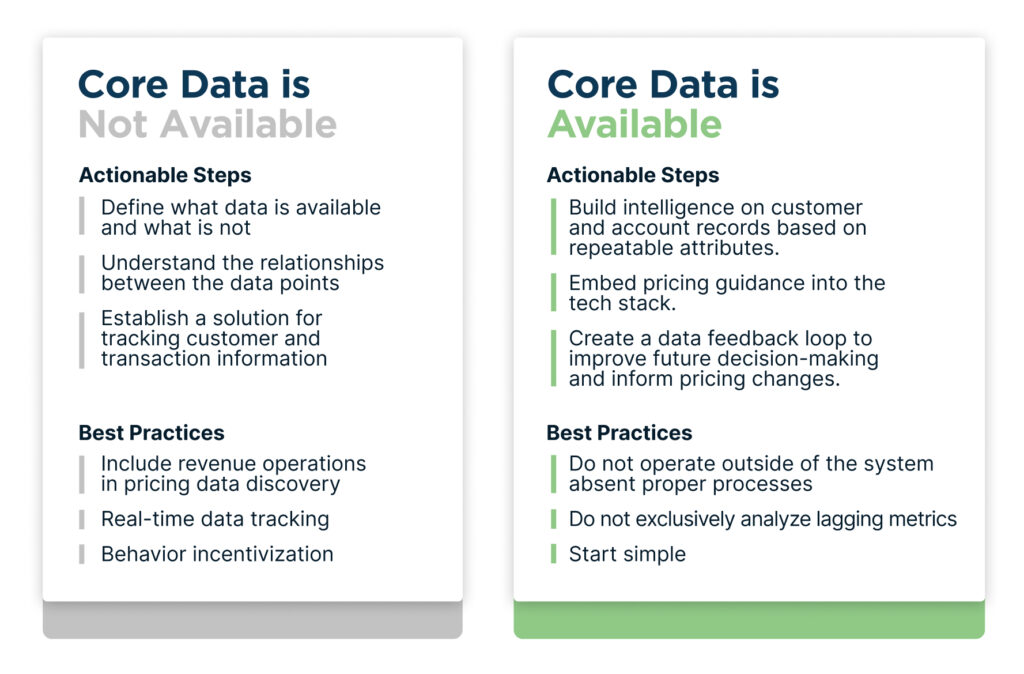

I recently had the privilege of interviewing my colleague, and Cortado’s revenue operations practice leader, Robert Gammon. Our discussion highlighted two distinct scenarios – one where core data, defined as invoice, customer, and product masters, is unavailable, and a second where this core data is readily accessible.

This article will serve as a brief recap of key actions and best practices companies should consider, from the lens of a revenue operations expert, in support of effective pricing execution.

Situation 1: Core Data is Not Available

When core data is absent, Robert underscored the importance of building the data foundation prior to pricing conducting its diagnostic analysis.

Actionable steps to take at this stage include:

- Define what data is available and what is not: Identifying the gaps between what data is required and what data is available is straightforward but incredibly important. Natural follow-on questions delve into the ‘why’ for the gaps and the ‘how’ to close them.

- Understand the relationships between the data points: In the pricing context, requires the ability to complete the following statement: “I charge $x for y product when purchased by z customers”. This should be executed across the entire portfolio.

- Establish a solution for tracking customer and transaction information: This is typically where technology comes into play; customer relationship management (CRM) and enterprise resource planning (ERP) software are the most common for customer and transaction data, respectively. Many companies are not utilizing the full out-of-the-box power of these platforms, and a revenue operations expert, in collaboration with pricing and other key stakeholders, is well-positioned to make the required changes.

Ultimately, an inability to capture, track, and analyze critical data points makes it incredibly difficult to find success in realizing profitable pricing outcomes.

Robert highlighted three best practices to keep in mind during, and after, completing these steps:

- Include revenue operations in pricing data discovery: Pricing teams should include revenue operations in the initial data request and availability assessment. This helps to ensure any red flags are identified as early as possible.

- Real-time data tracking: Of course, this pricing data is dynamic as the customer population changes, additional transactions occur, etc. Tracking customer and transaction data is necessary but not sufficient; best-in-class companies track this information in real-time.

- Behavior incentivization: Sales incentive compensation usually takes the share of voice when discussing how to align sales behavior with pricing goals. In addition to this, it’s important to consider how to mirror this from a process/systems perspective. Revenue operations’ work can help to integrate the pricing process into the existing tech stack, making pricing stakeholders’ decision-making easier and faster.

Situation 2: Core Data is Available

When core data is readily available, the focus shifts to determining how to best leverage it for strategic pricing execution. Robert emphasized the importance of a well-designed CRM to act as the central data hub and to enable effective data governance.

Actionable steps to take at this stage include:

- Build intelligence on customer and account records based on repeatable attributes: A common example of this is having target prices for each like-for-like customer and product combination. Therefore, when a sales rep is speaking with a prospect about product A, and their profile matches customer segment B, the rep can offer a tailored price.

- Embed pricing guidance into the tech stack: Pricing guidance for sales reps, like the target prices mentioned above, should be embedded within the tech stack. Additional levels of sophistication can be added, a common example of which is to add green / yellow / red indicators to the rep should they feel it’s necessary to deviate from the stated target price.

- Create a data feedback loop to improve future decision-making and inform pricing changes: As this data accrues, it can be used in many valuable ways, such as reporting that help sales managers to coach their reps or pricing team analysis to identify price optimization opportunities.

Ultimately, the goal is to leverage the data to identify patterns and drive analytical recommendations that improve pricing outcomes.

Robert highlighted three best practices to keep in mind during, and after, completing these steps:

- Do not operate outside of the system absent proper processes: It is not uncommon for companies to take their core pricing data and export it into a BI tool such as Tableau or Power BI in support of historical analysis and/or business reviews. This is not inherently an issue; however, processes need to be in place to continuously refresh the data to ensure that decisions about today’s price aren’t driven by transactions from six months ago.

- Do not exclusively analyze lagging metrics: Measuring historical performance with lagging metrics is very valuable; however, leading indicators are necessary to gain early visibility into expected market changes. For example, if a company is always a quarter late to change its pricing in response to cost fluctuations, it is almost certainly losing market share to its competitors who are quicker to offer market relevant prices.

- Start simple: For companies that have never tackled these steps before, it is important to start simple, get early wins, and layer in additional sophistication gradually alongside growing adoption. A widely utilized solution, even if not fully optimized, can drive behaviors that substantially improve a company’s ability to capture the value that its pricing creates.

My discussion with Robert reinforced how vital collaboration between revenue operations and pricing leaders is in ensuring successful pricing execution. At Cortado, the revenue operations capability is the nucleus of our framework for a reason— it is a foundational requirement of all Go-to-Market disciplines, and pricing is certainly no exception.