The Cortado Group recently hosted the Fall Round Table for Managing Directors in Private Equity at The Battery in downtown San Francisco. In preparation for this event, we surveyed this audience across 41 different Growth/Buyout firms around the US. We learned how these operating executives approach their work to drive a maximized exit multiple. Woven within the survey, we embedded the common constraints we routinely observe from hundreds of consulting engagements. This article shares our findings from the survey and the dialogue of PE leadership from this exclusive event.

The Managing Director is commonly tasked with driving top-line revenue within every portfolio company in their fund(s). While the actual execution of sales and marketing effectiveness is often formulaic, the frameworks, approaches, and philosophies can be quite unique. To be effective, this role needs to provide consistency of strategy and execution across the entire portfolio.

Given the extent of their influence on the success of a PE firm, the Commercial Excellence (CE) role should be at least as clear as that of an Operating Partner or Investor. But that doesn’t seem to be the case. There is a great degree of variability, even among seemingly very similar firms and these differences were on full display last week at our event.

The Need for Sales Excellence in the Middle Market

Much has been written about how competitive deal-making has become in the lower-mid and mid-market. Investment dollars flow to the best-performing firms. These firms are held to ever-higher standards of fund performance to sustain future investments. Not that long ago (perhaps 10 years), this reality created the need for firms to differentiate themselves beyond just the multiple offered. If a founder, or other investors, see a clearer path for scaling their business and realizing its fullest potential, acquirers need to paint the vision clearly of a prosperous future.

The large (mostly Enterprise-focused) PE firms long before had developed teams of analysts and practitioners to remake a company’s Go-to-Market (GTM) with great success. It was only a matter of time before the practice made its way to the mid-market and lower-mid market. As private equity began to see the advantages of this role, they began to invest in the CE leader. This provides better visibility and predictability into value creation using a more purposeful approach. Higher exit multiples drove the appetite to expand the effort experiment with this new approach.

The Survey and the Reactions

Hypothesis 1: Commercial Excellence Leaders are forced to operate tactically and sometimes struggle to impact the broader portfolio of companies.

The Role of a Sales and Marketing Commercial Excellence Leader

The greater goal in Private Equity is value creation, therefore the role of this position is to facilitate this process from due diligence to exit with all the fund’s portfolio companies as relates to those company’s GTM efforts. This broad definition is at the heart of the issues we discuss; How to leverage the scarce resources (high-quality A-player executives) to affect positive change across sometimes dozens of complex businesses.

Proof Points:

- 2/3 of respondents reported being responsible for more than 15 companies

- Over half reported that they are able to focus on less than 4 portcos at one time

- The average number of people dedicated to assisting portcos with sales and marketing is 4

Live Session:

Approximately sixteen PE firms were represented at Cortado Group’s Fall Round Table for Managing Directors event. The lively discussion centered around the staffing ratio of Commercial Excellence (CE) leaders to portcos in the findings and this generated an exchange of ideas about the root cause and pivots required. In some cases, with firms such as Riverside, K1, and Marlin Equity, leaders reported experimenting with the ratios of CE leaders to portfolio companies. Overall, there was little consistency among firms that revealed the complexity of the challenge. The survey findings indicate that, while the number of portfolio companies may be great, these CE leaders are only able to focus on a few at a time. If true, our hypothesis at this made their positions highly tactical; less strategic than serving the goal of “value creation” and more fixing “broken” companies. Some in the crowd agreed, however, veterans discussed their techniques for serving the greater good while dealing with struggling companies.

Panelist Drew Kiran of K1: “75% of the battle is Talent” he stated. “When we get the right person in the chair, one who can scale the business, my role changes to become more strategic. As a result, we focus on talent evaluations from the point of the investment, even earlier if possible. That is how I can cover more companies and remain strategic.”

“Another technique is to stay in touch with the best Sales and Marketing leaders in the fund – I can learn from them what works and what doesn’t.”

Panelist Dan Perry of Parthenon Capital: “At first it was a matter of getting the Investment Partner to understand what can or should be done at different stages of the company’s development. I break it down into different areas of engagement and pinpoint what that Deal Partner feels would be most effective. For instance, I can build the foundation (Personas, Buyer’s Journeys, Process, etc.) or I can help with Forecasting and Pipeline Issues if that is an urgent need. Sometimes the best focus is to teach the fundamentals of coaching skills so the idea is not to try to do everything at the same time but to gain agreement on what needs to be done first.”

From the audience, we heard AJ Gandhi discuss harnessing the power of the other portfolio companies in the fund to share best practices. Marlin Equities uses as many as 30 events per year to bring together like-minded GTM executives. This best practice sharing event generates dialogue and creates opportunities for mutual support and advice.

Other firms reported a reliance on trusted consulting firms that provided targeted, short-term assistance.

The hypothesis that a Commercial Excellence Leader largely operates tactically and struggles to impact the border portfolio was partially supported. It was clear, from the conversation, that techniques employed to “stay strategic” and not get pulled into fixing problems found inconsistent success. Sales Excellence leaders need an overarching plan to guide their efforts to have an accumulative impact that drives toward the growth target. Without a plan, they will be pulled into a constant break/fix cycle that does not optimize value creation.

Hypothesis 2: Sales Excellence Leaders have influence, however often they are not able to affect change with the biggest hurdles of portfolio growth.

Affecting Change

A consistent theme we heard at the event was the power of the Deal Partner (Lead Investor) to dictate the work of the Sales Excellence (SE) Leader. This is particularly valid when the Firm does not use an Operating Partner model. Many described how important it was to initiate proactive communications combined with continually reinforcing the interdependency of all GTM functions.

“The portco teams are very smart but a lot of them do not come from a Sales and Marketing background. As a result, we need to continually discuss what and why something might need to be done within the portco” an audience member volunteered.

The findings point to the conclusion that SE Leaders are trusted and are deferred to when sales and marketing questions arise. However, they are not pulled in enough to broader cross-functional GTM challenges where sales and marketing are not the focus. Often, these GTM challenges involve sales and marketing as a key facet of the larger picture. This limited view of when to turn to SE leaders for advice brings the SE leader downstream of key decisions and often the tactical actions required. It’s not uncommon for the SE leader to spend more energy working to unwind decisions made without full knowledge of the downstream impacts on sales and marketing.

Proof Points:

- All respondents said that portfolio companies willingly defer to them for sales and marketing advice (response “Often” or “Always”)

- The top 3 requests for consultation from Operating Partners, Deal Partners, and CEOs are Issue Diagnosis, Talent Evaluations, and Reporting

- 3 of the top 5 inhibitors to growth are Portco Talent, Misguided CEOs, and the Portco’s Culture; factors that are largely out of the direct purview of the CE Leader

Live Session:

While many (if not all) participants felt that ‘misguided CEOs” and “portco culture” were more difficult to directly correct, Portco Talent (which ranked #1) is an issue they feel a great deal more control over. The discussion ensued around differentiating between working with the Founder-CEO and the PE-Placed CEO. “Founders take much longer to decide to move on from poorly performing (talent) as they are loyal to the ones that helped them scale to this point. The reality is many of the leaders in the run up to $15-$20M do not have the skill set to scale to $100M. New challenges & complexities require proven performers. If you create the right relationship with the CEO you have the ability to influence change. When change happens quickly with a new GTM leader, we can really improve the trajectory of the company,” said Kiran.

The most critical function of the SE Leader is gaining agreement on how and when leadership talent will be evaluated. The foundation of the agreement is established by discussing together and selecting an objective talent evaluation tool. This approach will ensure the go-forward leadership team is determined before or shortly after the transaction. The group described various tools they use which will be a topic for future posts from Cortado Group.

The other impediments to portco growth seem more elusive according to the panel. Two panelists expressed the importance of building credibility and trust with the Deal Team over years of working together. Mike Drapeau of Resolve Growth Partners underscored this working dynamic; “Before you get involved with the portco, you must establish a clear understanding with the Deal Partner.” Addressing a “misguided CEO” or a culture that conflicts with the goal of value creation and growth requires active buy-in. This buy-in should occur not only within the Deal Team but also from the directors on the board. The round table discussion group agreed that, when observed, these issues must be addressed in most cases by the CE Leader.

Again, the hypothesis was partially validated. Many however felt that portco talent is owned directly by the CE leader. The consensus was that this role needs to perform three key talent functions: Assess existing talent as early as possible assist with defining roles and actively participate in leadership selection.

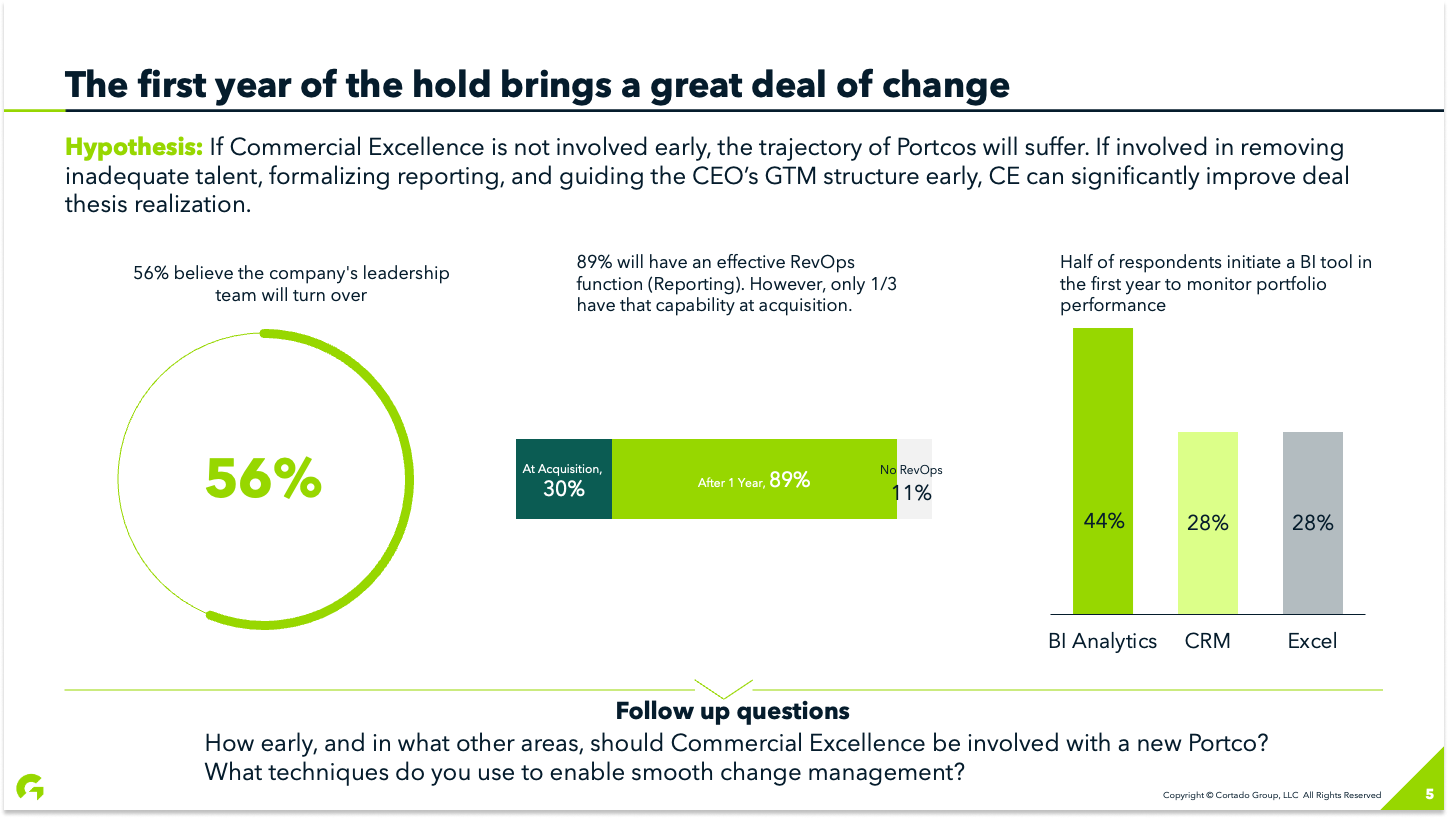

Hypothesis #3: If the Commercial Excellence leader is not involved early, the trajectory of portcos will suffer.

The First Year of the Hold

Nearly unanimously, Commercial Excellence (CE) leaders report having a playbook for the early days of the hold period. While some use formal checklists for the first 90-100 days, others use a diagnose/prioritize approach which is less regimented. It was clear from the feedback of this crowd that there was a high level of interest in not waiting for the investment to materialize. But rather the preference is to begin planning at the LOI stage (or even earlier at the point of initial evaluation). Given the earlier discussion regarding portco talent, rapid resource planning in the early stages of the hold is critical.

The first year is typically marked by a good deal of instability that can quickly work against the realization of the deal thesis. Focused effort and early planning were reported as the only way to avoid “a dumpster fire” as one audience member put it.

Proof Points:

- 56% of CE Leaders believe that the leadership team will exit in the first year

- There is an increasing ability to scrutinize new acquisitions. with about 2/3 of acquisitions suffering from insufficient reporting capabilities —by the end of the first year, 90% will have this ability

- There is an increasing use of tools to monitor and measure portcos, half of firms insert business intelligence tools to automate the reporting process

Live Session:

The consensus from the discussions surrounded the differentiation of founder-led versus a purchase made from another firm. The founder-led first year is far more challenging. “Most of these companies don’t have a RevOps function and don’t really know how to pull one together – some don’t even know why they need it,” said Perry. The need for the PE firm to track against their thesis is critical to delivering predictable results. It’s the responsibility of the CE leader to establish the tools required to bring clarity and accountability to results. How to make this happen effectively seemed to be another area where firms are divided.

To build an accurate reporting process, there were three distinct paths articulated: 1) Hire a talented RevOps leader or, place a capable CRO that can build this function themselves, 2) Level up existing internal resources at the portco through direct interactions, or 3) Engage with a trusted consulting firm to design and build the process. Opinions varied on the best approach, while it seemed largely dependent on opportunistically leveraging existing portco talent.

Our conclusion was that the increased first-year scrutiny was partially causing the leadership team to exit – a point that seemed to be supported by the crowd. “These guys don’t like anyone looking over their shoulders” one audience member added.

Our hypothesis was supported. Active involvement from the CE Leader early in the hold will set the direction. This early engagement approach greatly impacts the PE firm’s ability to affect the value of that company at exit. The combination of departures from executives at the portco, the urgent need to understand what is and isn’t working with the GTM strategy and execution, and the need to understand what investments need to be made in the business necessitates this involvement.

Conclusion

The ideal CE-guided playbook for orchestrating portfolio companies’ profitable growth is emerging for Private Equity in the mid-market. When one observes the lack of consistency in approaches across similar firms, the obvious conclusion is to reconsider the previous SMB approach. Investments made in the CE function by fund managers need to be reconsidered with a new approach tailored to the mid-market. Mid-market considerations include:

- Building a growth-focused team to address the recurring issues associated with scaling a business and/or outsourcing this capability as needed

- When and how to make the necessary changes are now predictable in a portco’s journey;

- How much autonomy to give the CEO knowing they may not have the ability to rapidly scale a company

All these considerations contribute to the desire to know more about what is working and what needs to be architected for mid-market success.

The Cortado Group will continue to engage and lead this discussion and share our findings with this audience. We would like to thank the panelists and attendees of the round table event for their insights and contributions.