Private equity firms can look to the technology stack as significant leverage when maximizing portfolio company performance. The technology stack, the set of tools and technologies that support business operations, is often full of redundancies. At the same time, the stack often lacks the core competencies necessary for success. The confusion that arises when multiple applications solve the exact same problem kills productivity.

Unstructured and bloated tech stacks contribute to inefficiencies and missed opportunities. As more technology elements are involved, the private equity technology stack grows, creating more data silos or integration points. Optimizing the tech stack reduces costs and improves performance. The sooner you do this in the investment cycle, the greater the multiple.

The significance of a strong private equity tech stack will be addressed in this article, along with strategies for reducing technical debt and success-oriented optimization.

What’s included in your tech stack?

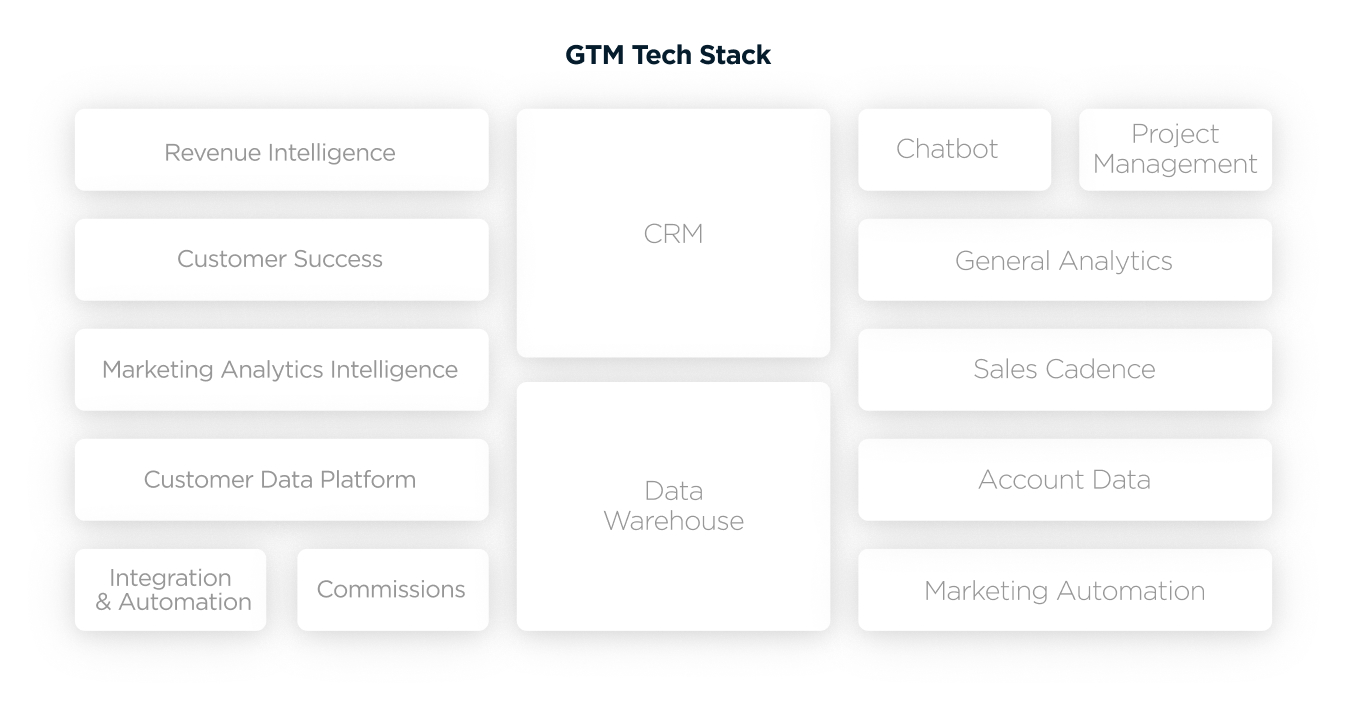

The tech stack is intended to enhance your Go-to-Market (GTM) strategy. The ideal tech stack varies from business to business, although the fundamental framework remains constant. Tech stack components should answer the following questions:

- Will the GTM engine be streamlined?

- Will it help you scale up?

- Is the user experience intuitive enough to minimize training and ramp-up time?

- Will the ROI be immediate?

You’ll have the makings of a reliable, cost-effective, and efficient private equity tech stack if the elements of your tech stack can respond to these challenges.

Understanding Technology Debt in Private Equity

Technical debt is a term used to represent the costs associated with maintaining outdated, inefficient, or underutilized technologies in your tech stack. Processes grow sluggish as a result, and productivity declines while costs grow. Technology stacks can drag down EBITDA as it devalues the company. Portfolio companies can be liberated from resource-draining technological debt.

Optimizing the tech stack

The performance of portfolio firms may be greatly influenced by a well-designed and effective technological stack. Private equity firms can help portfolio companies create a strong foundation that boosts productivity and profitability by improving the technological stack.

For instance, a portfolio firm may use Salesforce CRM to handle relationships with clients and may have a custom-built org structure built to enable them to capture all the data points needed from various sources. Data accessibility is a vital component. However, due to the many different fields and unique objects to navigate through, in addition to complex process rules, the UX becomes laborious and complicated. This design is more harmful than good as sales personnel don’t comply due to non-intuitive interfaces. Better results occur with a clear vision of what needs to be acquired and displayed is established. The data architecture can be planned to take the shortest route possible to create a CRM that’s efficient and provides valuable insights.

Here are some strategies private equity firms can use to optimize their tech stacks:

Analyze and eliminate unneeded technologies.

Companies’ tech stacks expand and become inefficient as a result of acquisitions or mergers. Organizations can identify and remove the burden of unnecessary technology by performing regular reviews of the tech stack. This reduces expenses and maximizes performance. For example, a company acquired two smaller IT companies. Post-acquisition, the company’s technology stack is filled with obsolete redundant, and overlapping components. The company assessed the tech stack with a third-party consulting firm to understand the impact and minimize disruption of streamlining the tech stack in a smart way. A detailed examination of the entire tech stack revealed several overlapping technologies. For instance, we discovered that both companies were using multiple sales enablement tools, which resulted in squandered work and higher expenses. TechCorp considered this until it opted to combine customer data into a single system and terminate one of its sales enablement tools. Processes are simplified as a consequence, duplication is eliminated, and platform maintenance costs are reduced. Along with finding these redundant technologies, we also found additional redundant technologies, such as unnecessary project management tools and communication platforms, and we replaced them with more practical and integrated alternatives. TechCorp dramatically reduces complexities in its technology stack and boosts productivity throughout the entire business by periodically reviewing and cutting unnecessary technology. Through the optimization of the technological stack, employees are spared from needing to handle multiple redundant platforms and are able to focus on learning an integrated set of tools that lowers costs and improves productivity.

Prioritize important systems.

Organizations should give priority to important systems and implement technologies that work effectively with them. By doing this, disruption is kept to a minimum, and company goals are achieved. For example, companies should embrace technologies with native connectors if they use Salesforce CRM or SAP financial management software. DocuSign for e-signatures and Salesforce transaction management, Salesloft for recording sales conversations, OpenText for recording invoices and receipts in SAP, and more.

Eliminate manual work

This can be achieved by becoming familiar with it and seeking out time-consuming task automation, particularly for your sales force. Profitability will be increased, and costs can be substantially reduced, by using an automation platform. For example, there’s a chance that the sales staff is still entering call details and adding email body attachments to the CRM. This takes a lot of effort, but sales enablement software can quickly automate it.

Private equity companies like Thoma Bravo, Advent, and Vista Equity Partners have optimized their portco technology stacks to remove the burden of unnecessary technology. Furthermore enhanced the tech stack with greater automation while maintaining the ability to be flexible to increase business efficiency and profitability.

Maintain an optimized tech stack for portfolio companies

Private equity firms must ensure portfolio companies have robust technology stacks and aggressively deleverage technology in order to maintain their competitiveness and maximize profitability. This entails regularly evaluating and maintaining portfolio firms’ technological infrastructure to comply with industry best practices and emerging trends. By empowering their portfolio companies to use technology as a strategic asset, private equity firms will maximize returns on investment by enhancing operational efficiency and scalability.

Both sales and marketing operations teams should routinely evaluate the present and future demands of the tech stack. This vision should be established to support the GTM ecosystem to stay on top of changing requirements and practices. Feedback loops should be created to learn about adoption progress and missteps, and can be used to identify additional improvement areas. By removing technological inefficiencies and gaps, private equity organizations will save costs and strengthen performance.

Utilizing a lean and efficient technological stack, private equity firms maximize their return on investments. By proactively managing technical debt, regularly analyzing the technology stack, and investing in suitable technologies, firms can increase productivity, reduce expenditures, and maximize overall portfolio profitability. We hope that the principles in this article may guide your team’s decisions, but if you don’t already have the time or expertise on staff, think about hiring a consultant to assist you in maximizing efficiency.

The most enlightened technology stack makes up only a quarter of a healthy RevOps engine that includes strategy, process optimization, technology, and data insights. To get a better idea of where you can allocate resources, download our Revenue Operations Diagnosis Tool.

Revenue Operations Diagnosis Tool Preview