It is well known that pricing is the most impactful value creation lever on profitability. However, it is common for the value that is created via pricing strategy and optimization to ultimately not be realized. The reasons range from a decentralized team structure inhibiting decision-making to a lack of process and technology stack.

Given these challenges, and pricing’s interconnectedness with its peer Go-to-Market (GTM) functions, continuous review and visibility is required to ensure success. After all, it is hard to fix what we cannot see. These challenges give rise to the need for performance management, and one of the most common methods to do so is via scorecards. Let’s explore three effective options and their key benefits.

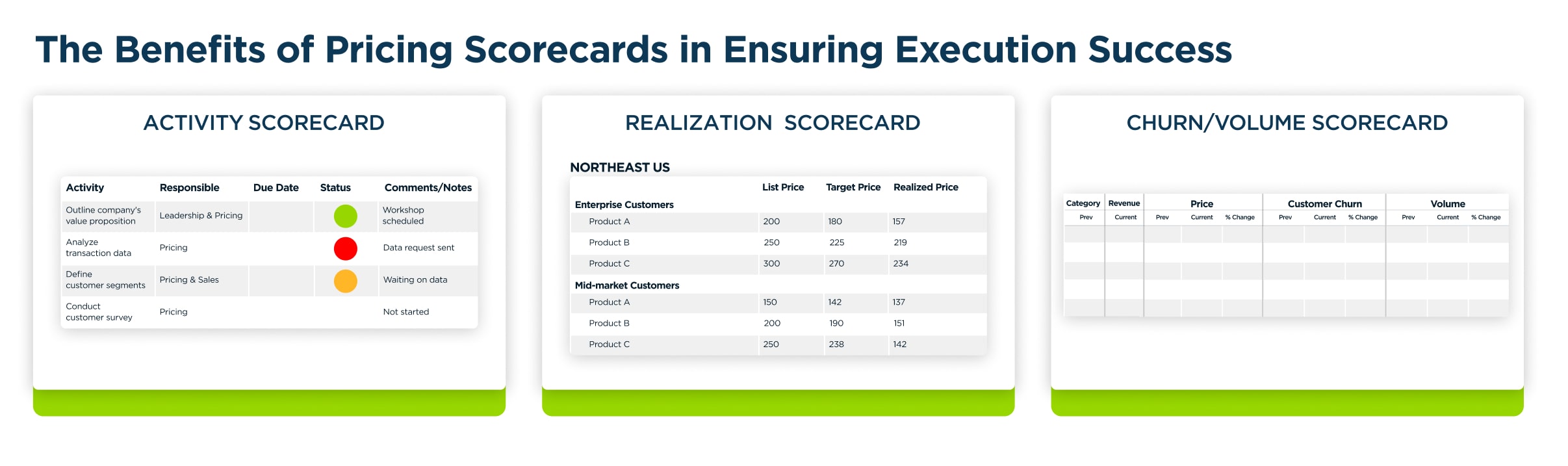

Activity Scorecard

What It Is: An activity scorecard, as it’s aptly named, provides an action-by-action buildup of the specific pricing activities that are required to ensure success. It includes mitigating measures and a status indicator (often red/yellow/green for simplicity) for each action.

Key Benefits:

- This scorecard provides transparency regarding the ‘who’ and the ‘what’ of pricing activities. For small organizations that do not have a dedicated pricing team, this can be particularly useful to ensure timely decision-making.

- They have the flexibility to be leveraged for both short- and long-term goals and can readily be integrated into existing strategic planning efforts such as monthly business reviews.

Realization Scorecard

What It Is: A realization scorecard measures pricing success at the cohort level (an example cohort = Product Category x Customer Type x Geographic Region). Pricing goals can, and often should, vary by cohort; this scorecard shows where pricing actions have been successful and where they have not.

Key Benefits:

- By measuring budgeted vs. realized price at this level, an organization gains visibility into pricing performance at the appropriate level of granularity.

- Provides actionable information regarding opportunities for improvement which can inform sales training and enablement efforts.

Churn/Volume Scorecard

What It Is: A customer churn/volume scorecard measures the impact pricing actions have on customer retention and purchase volume (represented by both quantity and revenue/ACV).

Key Benefits:

- By understanding pricing’s impact on volume, and organization can deepen its understanding of price elasticity.

- Measures the net impact of pricing across two critical KPIs. When pricing is appropriately integrated with business strategy, this scorecard informs price optimization opportunities by cohort.

Conclusion:

For private equity firms, there are compounding benefits when scorecards are executed across several portfolio companies. Operating partners can bring executives together and leverage these scorecards as basis for discussion on pricing learnings that can be applied from one company to another.

Overall, scorecards are an incredibly effective, and relatively light-weight method of pricing performance management. Each scorecard is valuable individually and become even more powerful when harnessed collectively.