Go-to-Market success requires varied disciplines to work as one. The companies that find the most success are not the ones who have the best marketing department, nor the ones with the best sales team. The companies that find the most success are those who appreciate and strengthen the connective tissue across disciplines.

An analogy, if you will. Crossfit athletes are some of the fittest people in sport. Their measurements of fitness range from swimming, to gymnastics, to olympic weightlifting. To be crowned the “Fittest on Earth,” one has to excel across all of these disciplines. And, importantly, to win it all, one has to avoid injury. The most common injuries are to the knee, elbow, and ankles – areas of connectivity. So, winning athletes focus on strengthening these areas of connectivity so that they can optimize their performance.

In the world of pricing, focusing on the connective tissue between Pricing, Sales, and RevOps is what enables pricing to perform optimally. This is because one of the most important moments in the pricing journey is at the time of quote.

Before quoting, marketing could have been fantastic, resulting in a wealth of inbound leads, but the wrong pricing can quickly sour the discussion and negatively impact conversion.

During quoting, the sales rep could win the deal, but have unknowingly offered a price below cost-to-serve, resulting in negative margin dollars for the business.

After quoting, if a bad deal is made, even the most savvy account management team will need years to improve that customer’s financial performance while avoiding churn.

Each of these points in time – before, during, after – require collaboration across pricing, sales, and revenue operations. I will address each of these in chronological order, guided by three foundational questions.

#1: What is the foundation I need in place to provide the right pricing guidelines for success?

Before effective quoting can occur, there needs to be established pricing guidelines for sales. In its most basic form, these guidelines provide visibility to a list price and a target price for a given product or service. Pricing is abundantly clear to sales reps and there is no need to waste precious time searching for it. In an environment where speed to quote and win rate are heavily correlated, such as in Industrials, this is incredibly valuable.

In order to improve the sales’ engagement, it is beneficial to include their perspective upfront to inform the calculation of a target price. As the team closest to customers, Sales can provide up-to-date market intelligence. Which products appear more sensitive than others? Which customer segments are most willing to pay top dollar because of the substantial value the product/service provides?

Engaging sales in early discussions increases the likelihood of price acceptance as well. The numbers are not coming from an unknown black box; rather, they reflect market realities and the shared ambition of the organization.

#2: How can I equip the sales team to leverage the approved pricing guidelines?

After ensuring the pricing leader/team and sales collaborated on creating the pricing guidelines, the next opportunity is enablement. For this, speed and ease-of-execution are the guiding principles.

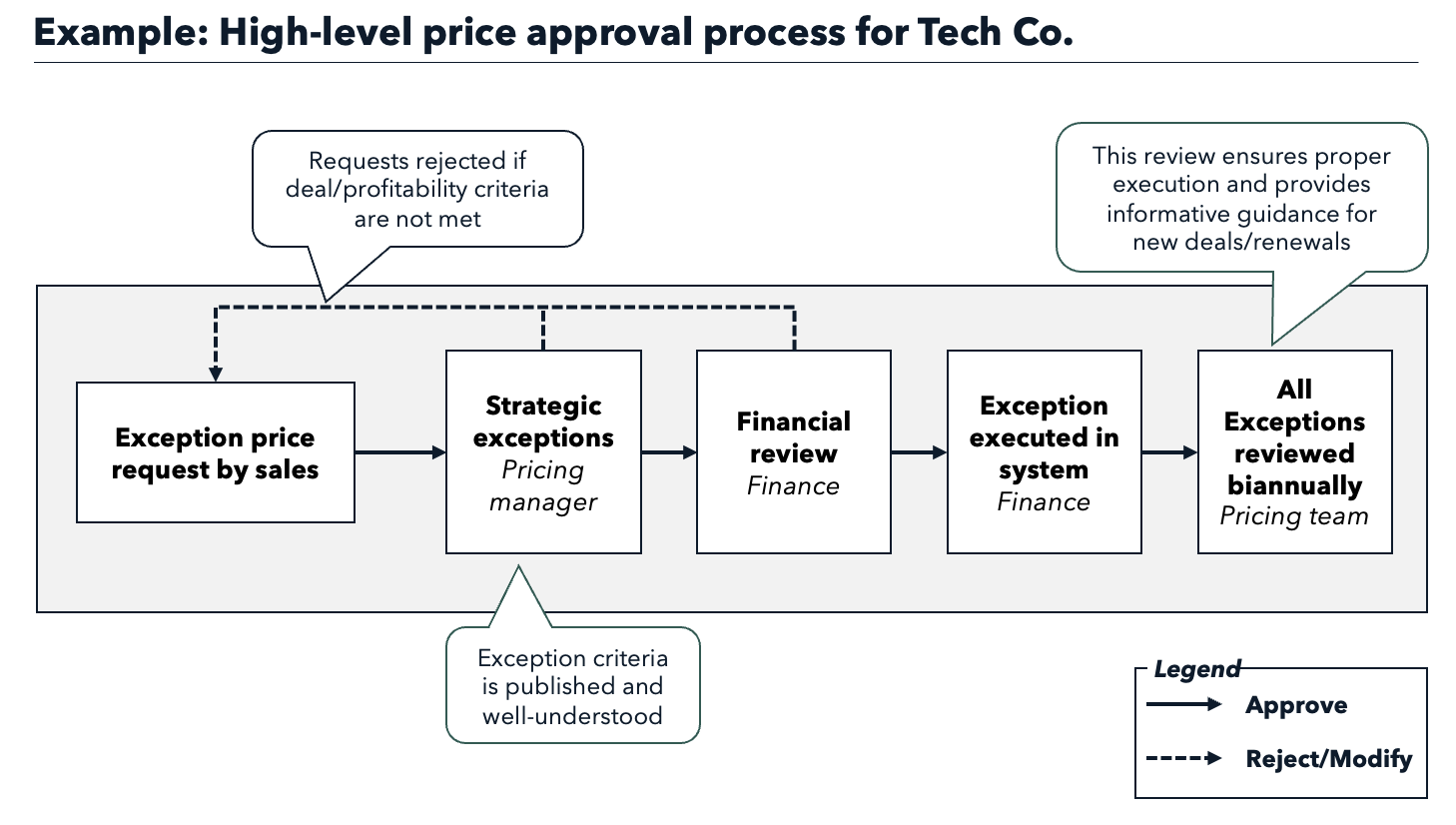

Soon enough, a sales rep is going to want to offer a price that is different from the stated target price. This is not inherently an issue, but it does require active consideration. This is where the establishment of a pricing process with a mechanism for approvals comes into play. A basic approvals process routes deals to the appropriate individual for review and ultimately, approval or rejection. The “appropriate” individual is typically determined based on the magnitude of the requested discount, the size of the deal at stake, the complexity of the deal, and/or the strategic priority of the customer.

I recommend following a three-step process for improving an organization’s pricing process:

1. Understand the current price and discount structure completely. Often, this is visually represented in a list-to-net price waterfall, which captures all of the potential discounts or sources of leakage that may exist (e.g., volume discounts, pre-pay discounts, etc.).

2. Establish the current state process and identify the gaps. Questions to ask at this stage may include:

- How is initial pricing determined?

- What triggers a deal review?

- What is the criteria used to approve/reject deals?

Answers to these questions will shine a light on the gaps that are present. It is not uncommon for deal makers to not have access to the correct information they need. It’s also common for the review bands to be too broad or too narrow, resulting in too many or too few deals being reviewed, respectively.

3. Develop a new process that resolves the gaps and is in service of the company’s pricing goals. For example, companies can often enjoy margin uplift by not permitting discounting on long-tail products (low-revenue products that, in aggregate, only represent 5% or 10% of revenue) without approval.

#3 How can I capture the right data and insights to know if the pricing strategy is producing the expected outcome?

Pricing is both an art and a science. In practice, this means that pricing is an ongoing discipline and therefore requires consideration over time. Pricing is not a one-time event that you can get right once, set it, and forget it.

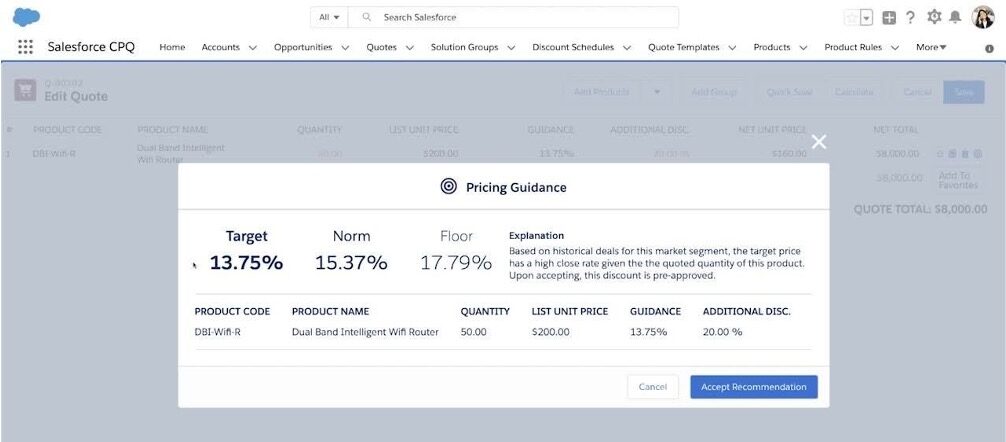

For this, Pricing’s partnership with RevOps is critical. A well-structured data ecosystem enables pricing to become effectively embedded in the tech stack. At its most fundamental, this means including a price list in the CRM. This gives sales visibility into product prices when engaging current or prospective customers.

Tech stack enablement should also include the aforementioned pricing approval mechanism. Gone are the days when an Inside Sales Manager hands a stack of papers to the Regional Sales Manager. This should be a fully automated process to ensure sales can quickly get customers the information they need. This approach also increases the ability for sales to enjoy a higher quota attainment. Schedule a discovery call with me to discuss how Cortado can help to increase value creation in your portcos through pricing and GTM strategy.