In the dynamic landscape of private equity, achieving success goes beyond strategic investments; it involves optimizing the performance of portfolio companies. One critical aspect influencing profitability is pricing effectiveness. This article uses Cortado Group’s pricing framework to provide an in-depth exploration of the essential strategies, metrics, and considerations for measuring pricing effectiveness in the context of portfolio companies.

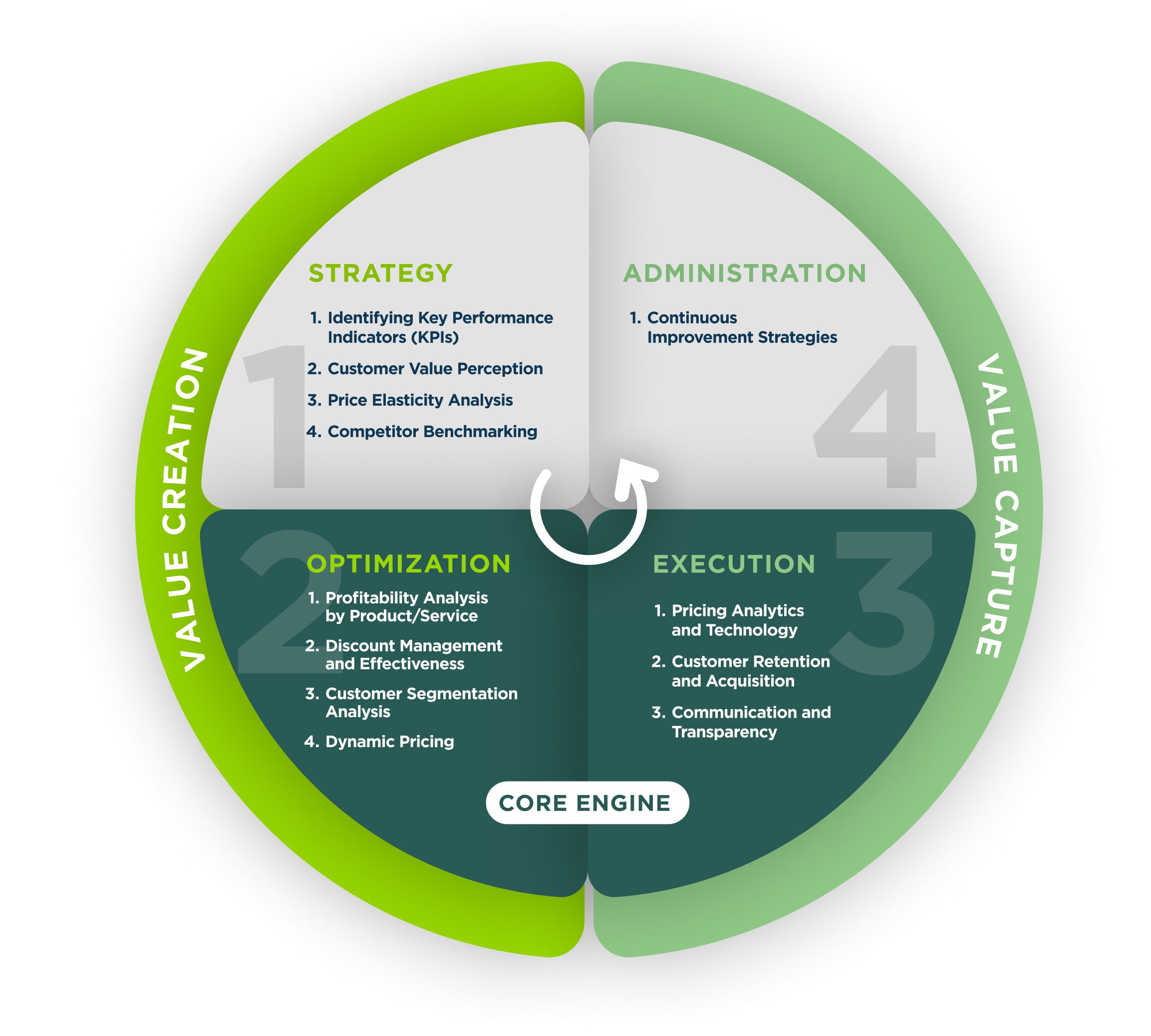

Our pricing framework focuses on four key capabilities:

Strategy:

1. Identifying Key Performance Indicators (KPIs):

To understand a company’s pricing effectiveness, it’s crucial to identify and leverage key performance indicators (KPIs). Beyond the fundamental metrics like gross margin, price realization percentage, and annual contract value, consider incorporating metrics such as customer lifetime value and net promoter score to capture the holistic impact of pricing on customer relationships.

2. Customer Value Perception:

Understanding customer value perception requires a nuanced approach. Alongside traditional methods such as a customer survey, employing sentiment analysis on customer reviews, social media mentions, and customer service interactions provide real-time insights into how pricing impacts the perceived value of products or services.

3. Price Elasticity Analysis:

Dive deeper into price elasticity analysis by considering cross-price elasticity and income elasticity. These advanced analyses help portfolio companies understand not only how their prices influence demand but also how changes in competitor prices or consumer income levels affect their market positioning, respectively.

4. Competitor Benchmarking:

Expand competitor benchmarking beyond simple price comparisons. Analyze competitors’ pricing strategies, promotional tactics, and customer engagement initiatives to identify competitive advantages and areas for differentiation.

Optimization:

1. Profitability Analysis by Product/Service:

A robust profitability analysis involves not only assessing the overall margin contribution of each product and service, but also understanding the cost structures associated with each. Implementing an activity-based costing analysis can help to uncover hidden costs to further optimize pricing strategies.

2. Discount Management and Effectiveness:

Beyond evaluating the impact of discounts on sales and profitability, assessing which customer segments respond most positively to discounts can influence decision-making in peer go-to-market functions like marketing and sales. Insights may also inform dynamic discounting strategies tailored to specific customer behaviors and preferences.

3. Customer Segmentation Analysis:

Utilize advanced analytics and machine learning algorithms for precise customer segmentation. Implement personalized pricing strategies based on customer demographics, behavior, and purchasing history to maximize revenue from diverse customer groups.

4. Dynamic Pricing:

Integrate scenario planning with dynamic pricing models. This involves not only anticipating market changes, but also dynamically adjusting prices based on real-time data, ensuring portfolio companies are proactive in their approach.

Execution:

1. Pricing Analytics and Technology:

Embrace predictive analytics and artificial intelligence to enhance pricing analytics capabilities. Predictive models can forecast future market trends, enabling portfolio companies to proactively adjust pricing strategies.

2. Customer Retention and Acquisition:

Develop a comprehensive framework to analyze and manage interactions with customers. Assess the impact of pricing on customer churn rates, customer acquisition costs, and customer lifetime value to optimize pricing for long-term profitability.

3. Communication and Transparency:

Strengthen communication channels with customers by providing transparent insights into pricing decisions. Consider customer education initiatives through channels like newsletters and webinars to articulate the value proposition behind pricing adjustments, fostering trust and loyalty.

Administration:

1. Continuous Improvement Strategies:

Establish a culture of continuous improvement by incorporating pricing feedback loops with all key stakeholders. Encourage regular cross-functional collaboration to adapt pricing approaches based on ongoing performance insights.

Conclusion

Pricing effectiveness in middle-market portfolio companies does not need to be complex, but it does require intentional consideration and action. By integrating advanced analytics, leveraging technology, and maintaining a commitment to continuous improvement, private equity professionals can unlock the full potential of their investments. This guide can serve as a pricing roadmap for achieving sustainable growth and profitability in the evolving landscape of private equity-backed portfolio companies. It may also highlight capability gaps that require attention; schedule a discovery call with our pricing experts for a comprehensive assessment.